Withdrawal Buffers: A Bridge During Market Dips in Retirement

Navigating the ups and downs of the market can be particularly challenging when planning for retirement. One effective strategy to manage retirement assets, especially during market downturns, is to create a withdrawal buffer, which acts as a bridge when the market dips.

This article will delve into the importance of withdrawal buffers and how they can help maintain financial stability in retirement.

The Importance of Withdrawal Buffers

Most retirement assets are heavily influenced by the stock market. Relying solely on these market-driven investments can be risky. During market dips, continuous withdrawals can quickly deplete the balance, potentially shortening the lifespan of retirement funds. This is where a withdrawal buffer comes into play.

Creating a Buffer

A withdrawal buffer involves diversifying investments to include both market-influenced and non-market-influenced accounts. This allows non-market accounts to be used during market downturns, giving market investments time to recover. By doing so, a steady income stream can be maintained without depleting resources too quickly.

Benefits of a Withdrawal Buffer

There are many advantages of having a withdrawal buffer:

- Stability. Non-market accounts, such as cash reserves, bonds, or fixed-income investments, provide a stable source of income during volatile market periods.

- Longevity. By minimizing withdrawals from market-driven accounts during downturns, the lifespan of retirement savings can be extended.

- Peace of Mind. Knowing a buffer is in place reduces the stress associated with market fluctuations.

Buffer Advantages Explained

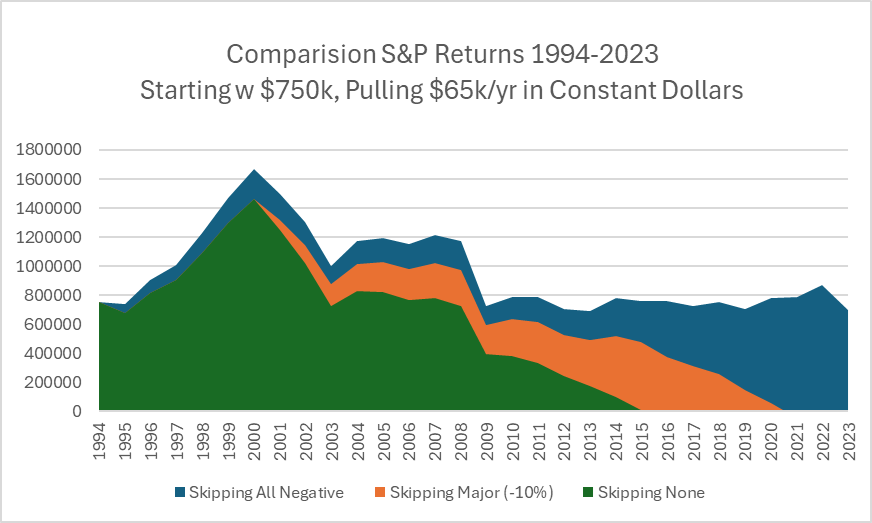

Starting with $750k in investments and withdrawing $65k every year (adjusted for inflation), The chart ”Comparison S&P Returns 1994-2023” compares the wealth amount that would have been achieved if:

- Withdrawals during All downturns of the market were skipped

- Withdrawals during major downturns (greater than 10%) were skipped

- No years skipped.

Notice,

Option 1 (the blue line) the investments is maintained through all twenty years and beyond.

Option 2 (the orange line) the investment is exhausted in 2020.

Option 3 (the green line) the investment is exhausted by 2015.

The difference in even skipping one downturn vs continuing to pull money in a down market are significant. Having a buffer investment is a critical piece of a balanced portfolio.

How to Get Started

The best beginning is to contact Wyman Financial Solutions and set up a meeting. Together, we will:

- Assess current portfolio. Evaluate the balance between market and non-market investments.

- Options & Implement. Wyman will provide ideas and suggestions based on your unique situation and implement needed steps for the agreed upon plan.

- Monitor & Educate. Annually review your portfolio, answer questions, and keep you apprised of market developments and market investment performance.

It is never too late to review and make changes to investments. Wyman Financial Solutions is here to help. Contact us today to schedule a quick call.