The passive investor is someone who values simplicity, stability, and long-term clarity, but also recognizes that investing, while important, is not where they want to spend their time. They know they need to invest and genuinely value its role in their future, yet their primary focus is on other things: their career, family, passions, or personal projects. They prefer a clear, reliable plan that works quietly in the background, allowing compounding to do the heavy lifting. For them, passive investing is the perfect blend: essential for their goals but not a daily task competing for their attention. They want to make a simple decision, essentially set it and forget it, and let their money grow while they focus on everything else. The passive investor embraces a straightforward buy-and-hold investment strategy.

There are simple ways to participate in the market that don’t require day-to-day trading or deep research into individual companies. In fact, very few people can beat the market. A person must be really active in researching companies and truly understanding what they are viewing, in order to have better returns than the S&P 500 historically. Below are “recipes” for the passive investor to get started.

Recipe One – Two Layer Cake

Layer One: Start Broad with the S&P 500 (INDEXSP)

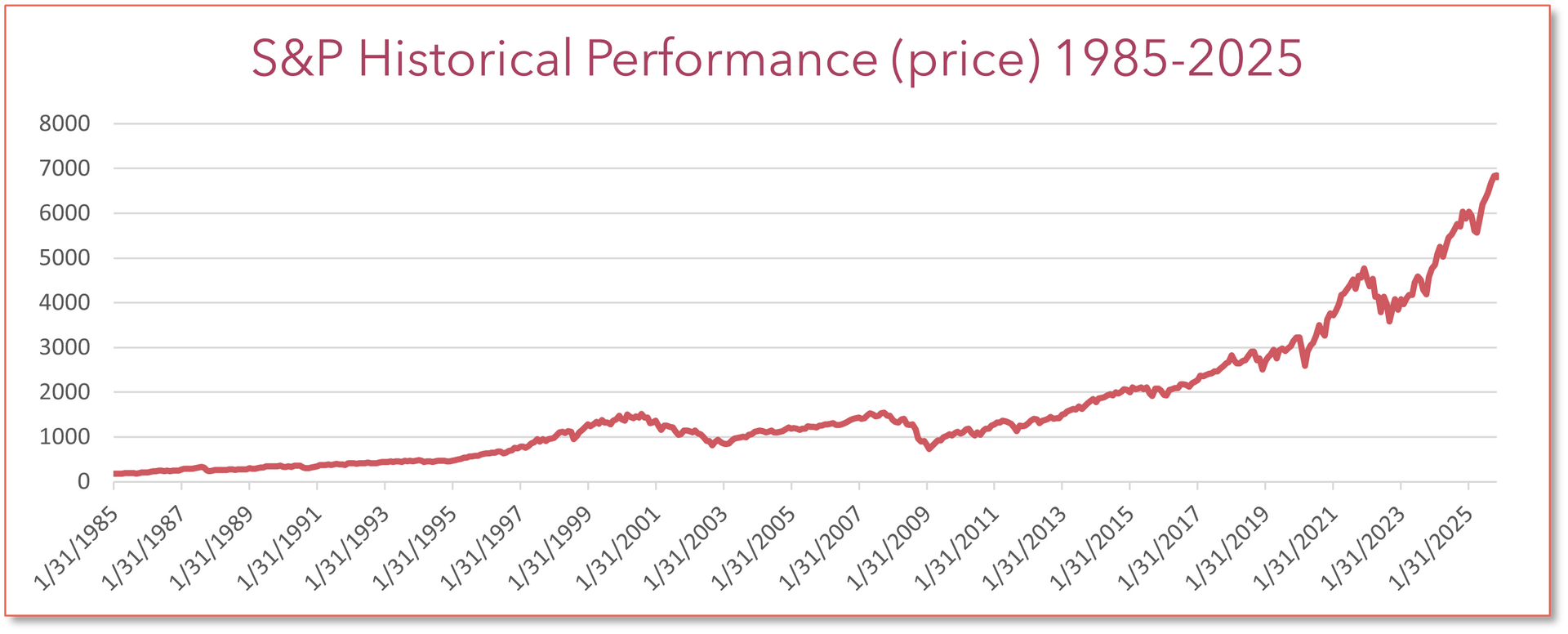

One of the easiest entry points is through the S&P 500 Index fund: INDEXSP. It includes the 500 largest publicly traded U.S. companies. Basically, it follows the U.S. economy, with all its ups and downs, but overall, the U.S. economy continues to grow. The chart below shows the historical performance of the S&P 500 from 1985 through December 1, 2025. Although not as exciting as watching individual stocks and companies do their thing, the S&P 500 can be a great place for the passive investor. Note: past performance is no guarantee of future performance.

Layer Two: Continue to add to the cake

In order for any financial investment to work long-term, have the potential to grow and help fund retirement, it must be invested in, meaning: consistently add additional money to the investment.

Investing regularly (monthly or per paycheck) regardless of market levels, is one of the simplest ways to reduce emotional mistakes and create a healthy financial habit. This approach is known as dollar-cost averaging:

- When prices are high, your fixed-dollar investment buys fewer shares

- When prices are low, it buys more

- Over time, this smooths out volatility and removes the stress of market timing

Set up an automatic transfer from your checking account to an investment account. Even small amounts, $50, $100 or $200 a month, build real wealth over time. One by adding additional dollars to the account(s) and second, by taking advantage of compounding. For more information on how compounding works, read my article explaining compounding.

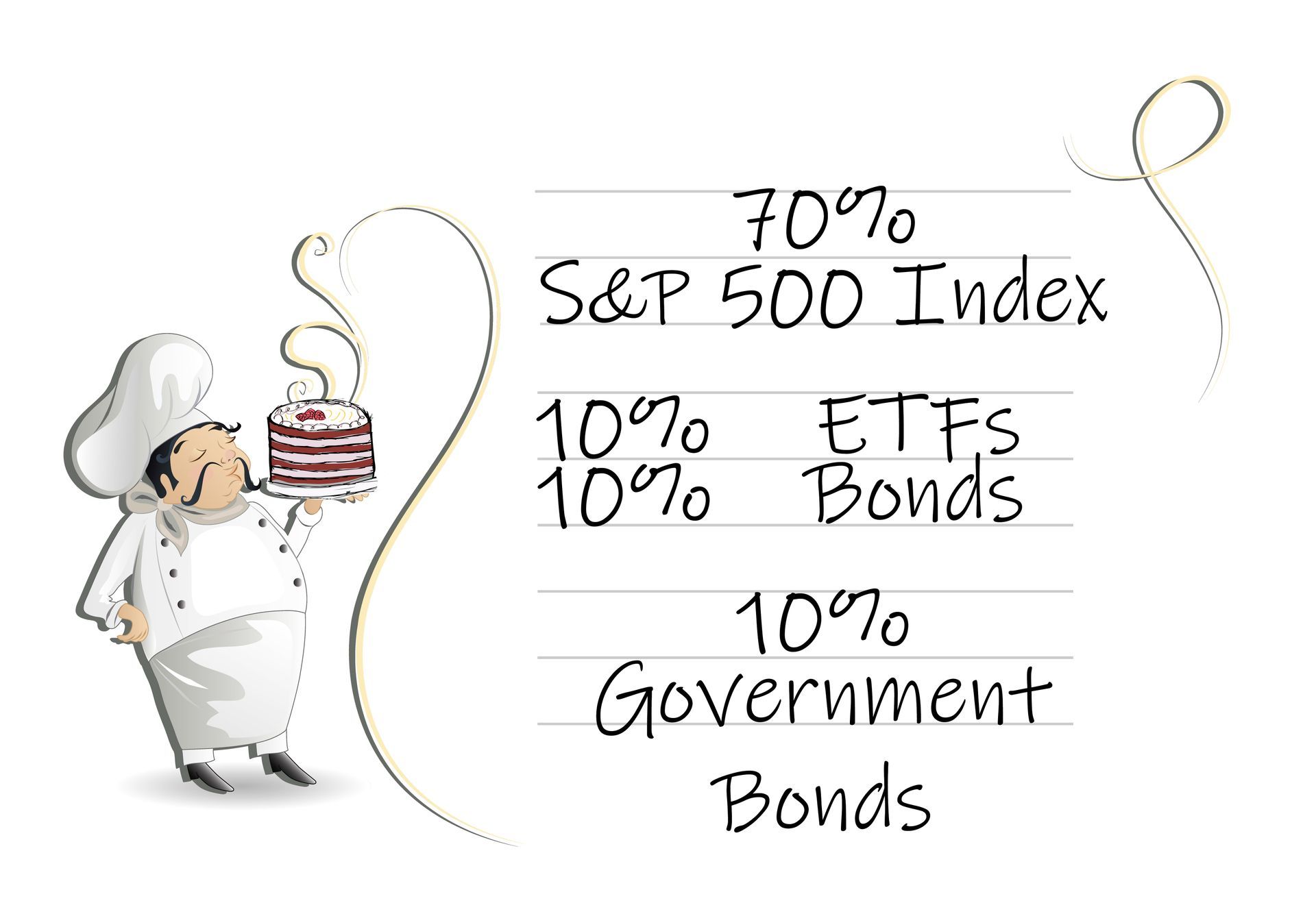

Optional Add-ons to the Basic Cake

Maybe a three-layer investment cake is wanted… (or do we dare four?) Here are some optional add-ons to the basic cake. And some suggested recipe ratios at the bottom of the section.

Add-on #1: Bonds (Government vs Corporate)

Bonds are loans you give to companies or governments in exchange for regular interest payments and the return of your principal at maturity. Government bonds are a specific type of bond issued by a national government and are generally considered safer because they’re backed by the government’s ability to tax and repay its debt. Corporate bonds, by contrast, are issued by companies and usually offer higher interest rates to compensate for higher risk.

Many people try a new recipe exactly as written the first time, then start making small substitutions or adjustments to suit their personal tastes—and investing can work the same way. Once a solid “base recipe” is built with core investments and safety nets, a person can experiment with a small amount by adding a dash of something new here or swapping an ingredient there to see how different choices affect the final result. This is where investing becomes fun: by setting aside a small portion (maybe 1% of the total portfolio or an amount that feels comfortable to lose, even as little as $100) as “curiosity capital,” there’s room to experiment with a small amount of risk.

Use it to experiment and learn.

Ideas to try:

- Buy into a company whose products you love, just to watch how real-world events affect its stock (partial shares or full shares can be purchased).

- Try a small, speculative ETF and track it against your S&P core over 6 months. (A speculative ETF is an exchange-traded fund that aims to profit from rapid, short-term price fluctuations in high-risk assets or strategies, rather than long-term, stable growth)

- Add a mutual fund that has history to it. A mutual fund pools money from many investors to buy a diversified portfolio of securities, such as stocks and bonds, managed by a professional portfolio manager. This diversification spreads risk and can offer potential steady returns, while professional management handles the investment decisions for a fee.

Action: Be sure to start a “learning log” noting what influenced price moves, how it felt, and what was learned about risk and reward.

Suggested Recipe for Experimenting:

70% S&P 500 Index; 15% ETFs; 10% Government Bonds; 4% Bonds; 1% Play

The purpose of the added 1% isn’t necessarily to make money fast, it’s to build literacy. With small stakes, markets can be observed in action and personally learn reactions to volatility, excitement, and disappointment. That experience makes a person a calmer, wiser investor when larger amounts are on the line.

Cautions

Always have Cash

Cash doesn’t earn much, but it buys flexibility and peace of mind. It’s like having a few cupcakes along with the cake. The majority of the batter (money) is in the S&P Index fund, but reserve a bit for the unexpected:

- Maintain 3–6 months of living expenses in an emergency fund.

- Keep short-term goals (like a vacation fund or home repairs) in high-yield savings or money-market accounts.

- Cash helps prevent selling investments during downturns to cover expenses.

And having extra cash (beyond the 3-6 months safety net) can allow for taking advantage of opportunities that only cash can create.

- Past performance is not a guarantee. Even the S&P 500 can have long flat or down periods.

- Volatility is normal. Corrections and bear markets are inevitable.

- Costs matter. Use low-expense ETFs and avoid unnecessary trading.

- Behavioral traps. Emotional reactions—panic selling or chasing hype—are the biggest portfolio killers.

Understanding the realities of investing helps a person stay grounded through both rallies and recessions.

We covered several different recipes to get started “baking” an investment cake. To begin, simply choose a recipe and start “baking”. It’s easy to avoid doing something new or uncomfortable. What if we get it wrong? But following a recipe makes getting started so much easier. New recipes can always be explored as desired.

In the years ahead, when it’s finally time to enjoy the investment “cake” that has been patiently baking, the early start will prove worthwhile. Perhaps new financial “recipes” will even be created along the way. And when guidance is needed, a financial “chef” (advisor) can offer support.

There are also far more retirement options than just “cake.” Pies, cookies, and countless other “treats” exist—much like the variety found in a balanced portfolio, where a Financial Advisor can provide insight and direction.