The Power of Financial Compounding: Why Starting Early is Key to a Secure Retirement

When you’re in your 20s or 30s, retirement might seem like a distant future, something to worry about later. But the truth is, the decisions you make now can have a massive impact on your financial well-being in the years to come. The key to building a secure financial future lies in understanding one of the most powerful concepts in investing: compounding.

In this article, we’ll break down how compounding works, why it’s so crucial to start saving early, and provide examples that illustrate its transformative power.

What is Financial Compounding?

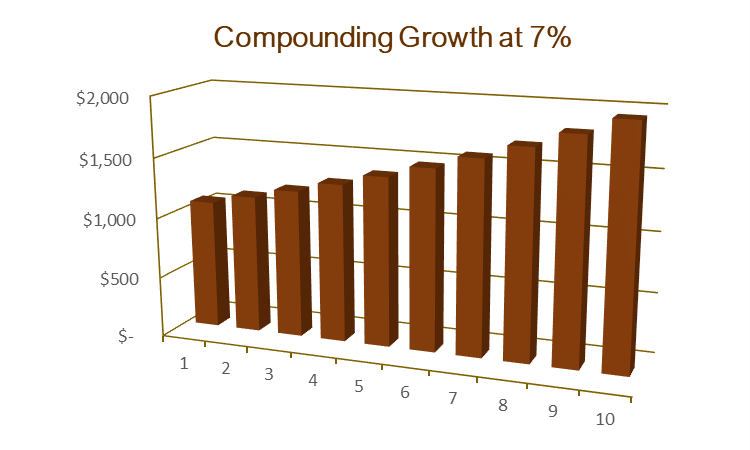

Compounding is the process where your investment earns returns not just on the original amount you invested (the principal), but also on the returns that investment has already generated. It’s often referred to as “interest on interest,” and it’s what can turn a small initial investment into a substantial sum over time.

Imagine you invest $1,000 at an annual interest rate of 7%. In the first year, your investment earns $70, bringing your total to $1,070. In the second year, instead of earning just another $70, you earn $74.90—because you’re earning 7% not just on your original $1,000, but also on the $70 you earned in the first year. This cycle continues year after year, with your investment growing at an accelerating rate.

The Importance of Starting Early

The magic of compounding is most powerful when given time to work. The earlier you start investing, the more time your money has to grow exponentially. It can be hard not to eat the cookie (use the money), but if you invest and let compounding work, the one cookie grows into a stack of cookies!

Let’s look at a couple of examples to see how this works in practice.

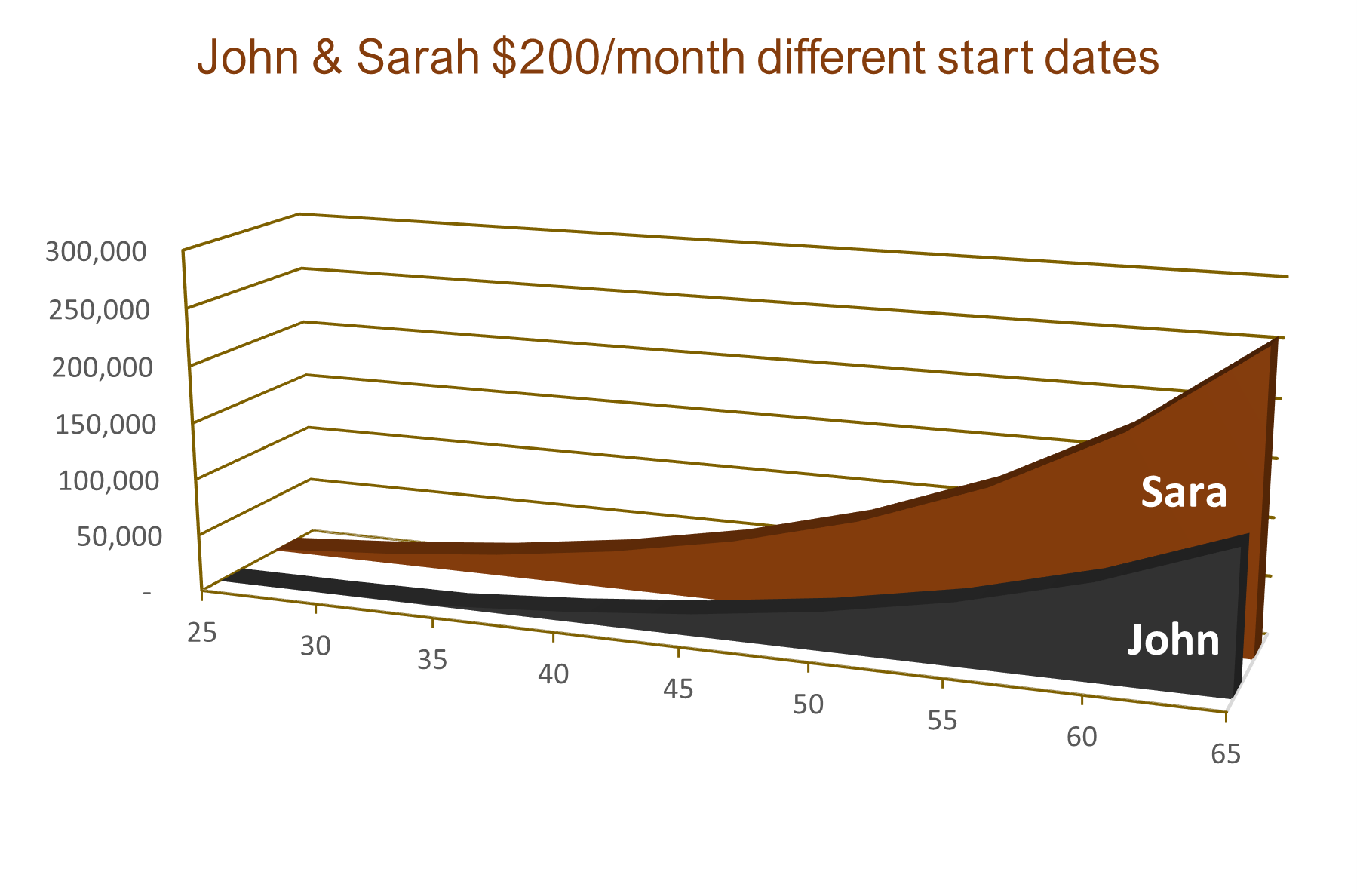

Example 1: Sarah vs. John Sarah starts investing at age 25. She contributes $200 a month to her retirement account, earning an average annual return of 7%. By the time she turns 65, she will have invested a total of $48,000. Thanks to compounding, her investment will grow to approximately $257,000.

John, on the other hand, starts investing at age 35. He also contributes $200 a month, earning the same 7% annual return. By the time he reaches 65, he will have invested $36,000, but his investment will only grow to about $122,000.

Even though Sarah only invested $12,000 more than John, her earlier start allowed her investment to grow more than twice as much by retirement. The key difference is time. Sarah’s money had an extra 10 years to benefit from compounding, which made a massive difference in the outcome.

FYI: The Rule of 72 The Rule of 72 is a quick way to estimate how long it will take for an investment to double at a fixed annual rate of return. You simply divide 72 by the annual rate of return to get the number of years it will take.

For example, if you expect an 8% return on your investments, you can estimate that your money will double in about 9 years (72 ÷ 8 = 9). If you start investing at age 25, and your investment doubles every 9 years, it could double four times by the time you reach 65. If you wait until 35 to start, you might only see it double three times.

The earlier you start, the more “doublings” your money can go through before you need it for retirement.

Why Compounding is Crucial for Retirement

Retirement planning isn’t just about putting money aside; it’s about making your money work for you. The longer your money is invested, the more opportunity it has to grow, and the less you’ll need to rely on your own contributions to reach your retirement goals.

Consider the impact of compounding on your retirement savings in a tax-advantaged account, like a 401(k) or an IRA. Because these accounts allow your investments to grow tax-free (or tax-deferred), you get to keep more of your money working for you, which enhances the power of compounding even further.

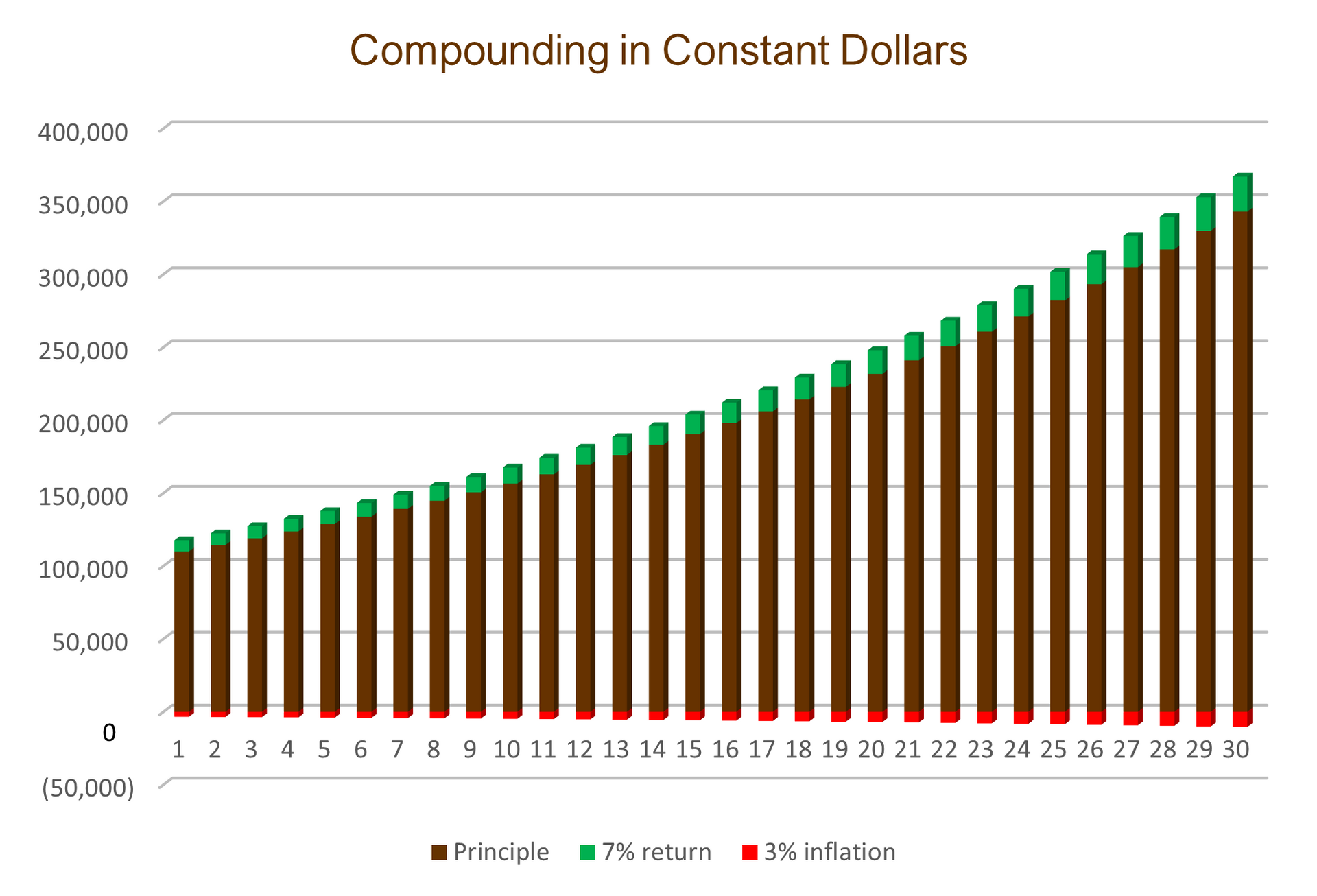

The Impact of Inflation One of the biggest challenges in retirement planning is inflation, which erodes the purchasing power of your money over time. The average inflation rate in the U.S. has been around 3% per year historically, meaning that prices double roughly every 24 years. To maintain your standard of living in retirement, your investments need to grow at a rate that outpaces inflation. In cookie terms, inflation means that one cookie reduces down to crumbs.

This is where compounding comes in. By starting early, you give your money more time to grow at a rate that can not only keep up with inflation but also provide real returns. For example, if your 100,000 investment earns an average of 7% annually, and inflation averages 3%, you’re still getting a 4% real return each year. Meaning your buying power increases! Over decades, this can make a significant difference in your retirement savings.

Overcoming Common Barriers to Starting Early

Even when people understand the power of compounding, many still delay starting their retirement savings. Common reasons include student loans, credit card debt, and the desire to enjoy their income while they’re young. While these concerns are valid, it’s important to recognize that even small contributions can grow substantially over time.

Start Small if You Need To If you can’t afford to save much right now, start with what you can. Even $50 a month can make a difference. As you pay down debt or increase your income, you can gradually increase your contributions.

Automate Your Savings One of the best ways to ensure you stick to your retirement plan is to automate your savings. Set up automatic contributions to your retirement account so that saving becomes a habit, not a chore.

Take Advantage of Employer Matches If your employer offers a 401(k) match, make sure you’re contributing enough to get the full match. This is essentially free money that can significantly boost your retirement savings and accelerate the effects of compounding.

Conclusion: The Future You Will Thank You

The earlier you start saving for retirement, the more you can take advantage of the powerful effects of compounding. By making consistent contributions and allowing time to work in your favor, you can build a robust retirement fund that provides financial security and peace of mind.

Remember, compounding is a marathon, not a sprint. Even if retirement feels far away, the steps you take today will set the foundation for your financial future. So, whether you’re just starting your career or have been working for a few years, now is the time to harness the power of compounding and start building the retirement you deserve. We all want to have cookies in retirement.