The Cost of Procrastination: Why Waiting to Plan Your Financial Future is Costing You More Than You Think

We all procrastinate in some areas of life—putting off that dentist appointment, delaying the gym membership, or avoiding that home repair project. But when it comes to financial planning, procrastination can have serious long-term consequences. The cost of waiting can translate into lost opportunities, higher expenses, and increased stress.

So why do people put off financial planning, and what does it really cost? More importantly, how can you take simple steps today to set yourself up for a more secure future? Let’s break it down.

Why Do People Procrastinate When It Comes to Money?

Procrastination in financial planning often stems from psychological and emotional barriers. Here are some common reasons people delay taking action:

- Fear of the Unknown: Many people avoid retirement planning because they don’t know where to start. The unfamiliarity of financial jargon and the complexity of investment options can feel overwhelming.

- Denial: Some individuals believe they have plenty of time or hope future circumstances will “sort themselves out.” They believe they can catch up later, underestimating the power of compounding interest, and overestimating how much can actually be caught up.

- Perfectionism: The desire to make “the perfect plan” can be overwhelming and often leads to inaction. People may wait until they feel they have enough knowledge, resources, or time to get it exactly right.

- Competing Priorities: Everyday expenses, family responsibilities, and short-term financial goals can take precedence, leaving retirement planning on the back burner.

Fear of Failure: Concerns about making the “wrong” investment or falling short of goals can cause analysis paralysis, where fear prevents any decision.

A Tale of Two Investors: Action vs. Procrastination

Let’s consider two individuals, Jessica and Steven, both 30 years old. For this illustration, they make the same amount at their jobs throughout their lifetimes. They each have the goal of saving for retirement, but they approach it differently:

- Jessica Starts Right Away: She begins investing $500 per month into a retirement account, earning an average return of 7% annually. After 35 years, when she is 65, Jessica has about $829,000 from that one investment.

- Steven Procrastinates 10 Years: He decides to start at age 40, contributing the same $500 per month at the same 7% return. After 25 years, when he is 65, he ends up with only $412,000.

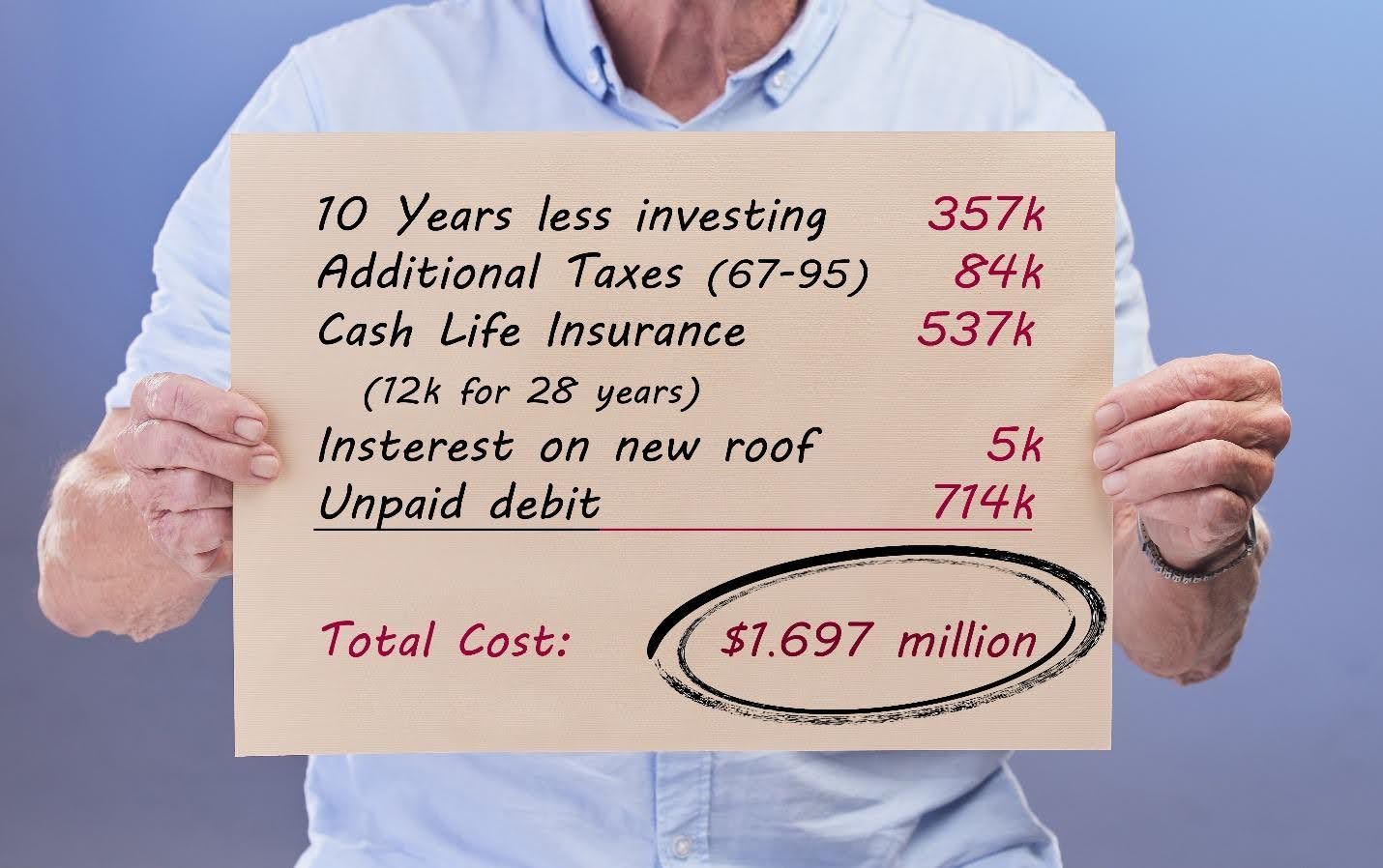

By procrastinating for 10 years, Steven ends up with about half of what Jessica accumulated. While Jessica invested $180,000 over her life time, Steven invests 120,000 but the difference in their investments is $417,000. So procrastinating ten years, cost Steven $357,000 in retirement (incorporating his lower initial investment). That’s the power of starting early—compound interest does the heavy lifting over time.

More Costs of Financial Procrastination

- Lost Investment Growth – Every year waited is a year of compounding returns lost. In Steven’s case it cost him $357k.

- Higher Retirement Contributions Later – To make up for lost time, late starters must invest significantly more to reach the same goal. For Steven, in order to have the same amount as Jessica in this investment at retirement, he would need to invest $12,000/year, a cost of 300k, or 120k more than Jessica. But he decided to think about that later.

- Fewer Opportunities

- for Strategic Tax Planning† – Proactive planning allows for tax-efficient investment strategies, which can reduce lifetime tax burden. Jessica put half her investments in a ROTH, which means she already paid taxes on that money. Steven put it all in a pre-tax investment. Assuming they both pull the same amount of social security at age 67 (~36k) and both pull the same amount out of their retirement accounts (~$46k), Steven will pay an additional ~$3,000/ per year in taxes because he didn’t diversify his pre and post-tax investments.

- for Strategic Investment Products†† – Some investments make sense to do when young, but lose their return value the older one becomes. Jessica purchased a full life insurance plan with cash value when she was 35 at @200/month for twenty years. Steven tried to at age 55, but health issues and the high premiums at his older age made it impossible for him to afford. The cost of Jessica’s permanent life insurance was $48,000 and she was able to pull $12,000/year tax-free from 67-95 for a total of $336,000 with an additional death benefit of $195,334 tax free to her beneficiaries (based on historical market trends). For a total cost of $48,000, Jessica’s return was $483,334 (subtracting out her initial investment). Add the non-tax nature of the investment and Steven racks up an additional $54k missing out on the tax benefit for a total of $537,334 based on his procrastination.

4. Limited Options for Emergencies – Without proper financial planning, unexpected expenses can derail long-term

goals, such as medical, roof repairs, or HOA assessments. Jessica had an emergency fund, Steven did not and had to put his new roof on a credit card, (paying $500/month at 18% for 3.5 years) = $5077 in additional interest payments.

5. Relying on Social Security Alone – Many retirement procrastinators find themselves overly dependent on

Social Security, which may not be sufficient to maintain their desired lifestyle in retirement. And in today’s environment, the amount of Social Security that will be available is questionable. Steven found himself in that boat and had

to continue working longer than Jessica.

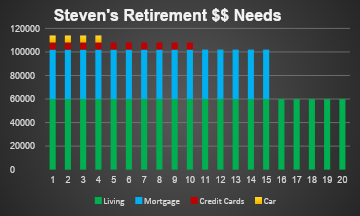

6.Higher Debt Levels – Without a clear financial plan, people are more likely to rely on credit cards and loans,

accumulating debt that becomes difficult to manage. Jessica made sure any expenditures could be paid off before she

retired, including her home. Steven had the philosophy of enjoy life now figure retirement out later. He carried a lot of

debt into retirement. His cost for retirement is significantly higher than Jessica’s, to the tune of $714,000 over his

retirement years, paying off debt (see chart), not to mention the additional interest he paid over his lifetime. He now has

to figure this into his retirement income needs.

7. Emotional Costs and Anxiety – Constant worry about finances can take a toll on mental health. Living paycheck to

paycheck, fearing unexpected expenses, and stressing over whether there will be enough in retirement can significantly

impact overall well-being including the immune system which can make people more prone to illness and missed

opportunities for career advancement.

The Tally

Based on his investments, Steven averaged $55,000 per year during retirement (accounting for inflation) until his investment ran out at age 89, then only had social security to draw from.

In contrast, Jessica was able to draw $79,000 per year during retirement (accounting for inflation) until she passed away at 95, leaving her beneficiaries the life insurance payout of $195,000 plus, the remainder in her investment accounts of $281,000 for a total of $476,000.

How Procrastination Affects Retirement Living

Procrastinating on financial planning can dramatically alter your retirement lifestyle. Without sufficient retirement savings, people may:

- Be forced to work longer than expected, delaying retirement by years or having to work at least part time during retirement. Steven had to continue working even when retired, as he lacked the money to make ends meet.

- Have to downsize their home, relocate to a more affordable area, or move in with children or friends. Steven had to sell his house to get out from under the mortgage payment and purchased a tiny one-bedroom condo.

- Struggle to afford healthcare and long-term care expenses. Steven had no long-term care and only the minimum of Medicare.

- Miss out on travel, hobbies, and leisure activities that was envisioned for retirement. Steven lived the high life during his earning and savings years then paid for it in his retirement years.

- Rely heavily on family members for financial support, creating strain in relationships.

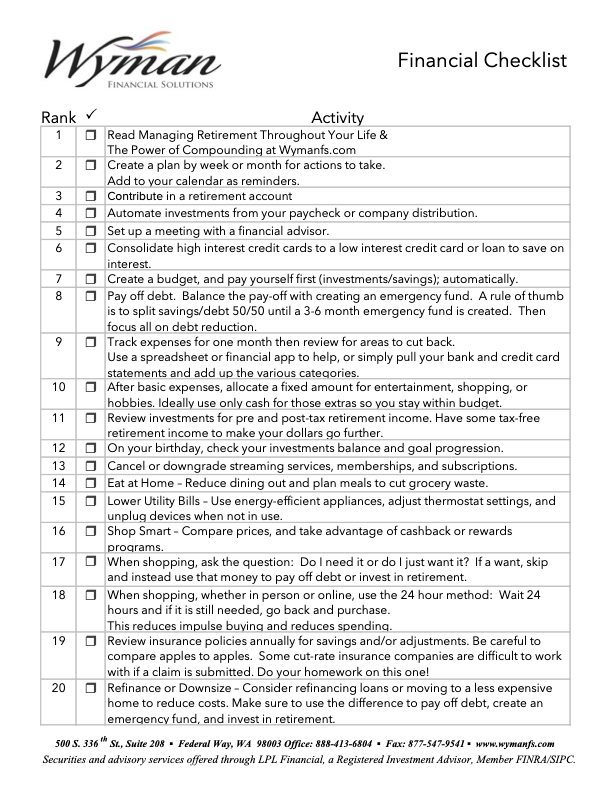

Simple Steps to Take Action Today

Create inertia and start making progress:

- Start Small – If the idea of saving for retirement feels overwhelming, begin with a manageable amount. Even $50 a month is better than nothing.

- Automate Contributions – Set up automatic transfers into savings and investment accounts. Think of paying yourself first instead of whatever crumbs are left over.

- Take Advantage of Company Benefits – if working for a company that offers a matching retirement plan, at least contribute up to the company match (ideally more!) Its free money! If there was a twenty-dollar bill on the floor, would you simply walk by? Or pick it up? (Hint: pick it up!)

- Prioritize an Emergency Fund – Having 3-6 months of expenses saved can provide peace of mind and prevent you from dipping into long-term savings for short-term needs.

- Seek Professional Guidance – A financial advisor can provide clarity and a customized plan tailored to your goals and risk tolerance.

Your Future is in Your Hands: What Actions will You Take?

Remember, financial security isn’t about being perfect—it’s about being consistent. Small actions add up over time, and the sooner you start, the better your outcome will be. Make a plan to complete one new financial goal each quarter, or even better, each month until your goals are reached. Here are some ideas to get you started:

Final Thoughts: The Best Time to Start is Now

Financial procrastination is costly, but it’s a habit you can break. Whether you’re 25 or 55, the sooner you take action, the more time you have to build a strong financial foundation. Don’t let uncertainty or fear hold you back—start today, even if it’s just one small step. Your future self will thank you.

*These hypothetical examples of mathematical compounding are used for illustrative purposes only and do not reflect the performance of any specific investments. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of investment risk. Actual results will vary.

**All guarantees are subject to the claims-paying ability of the issuing insurance company.

†These are fictional and illustrative forecasted scenarios only, in order to illustrate the points of the article. Illustrations are based on actual products available and use an average of 6% annual return.

††NEXT Financial Group, Inc. does not provide tax or legal advice. For such guidance, please consult your tax and/or legal advisor.