Leaking Money Series: Plugging the Hidden Holes in Your Finances. Part One – Food

What if by making some simple food changes, you could have

$62,053 more in your retirement kitty in just ten years?

By making simple changes in these five categories, you can make a significant difference.

- Food Waste

- Outside the Home

- Online meal delivery

- Shopping Composition

- Shopping Locations

Money has a funny way of disappearing. You work hard for it, save diligently, and plan for the future—but somehow, there never seems to be enough left at the end of the month. This phenomenon is known as "leaking money," the gradual and often unnoticed loss of funds through unnecessary expenses, inefficient financial habits, and lack of awareness. If left unchecked, it can have long-term consequences, especially for retirement savings. Unlike major financial mistakes, money leaks are typically small, recurring costs that add up significantly over time. Because they’re spread out and relatively minor individually, they rarely trigger alarm bells. However, their cumulative effect can be devastating to your overall financial health.

In this four-part series, we explore hidden ways people leak money and cover specific steps to “plug” the holes. As a bonus, the example savings will be added up for a total amount that could be invested.

Food Waste

According to the USDA, 31% of food was wasted in 2010, discarded into landfills. From a consumer standpoint, that means 31% of money used to purchase food is wasted as well.

https://www.usda.gov/about-food/food-safety/food-loss-and-waste/food-waste-faqs

According to RTS (a waste management company on the east coast), 43% of the total food waste comes from homes, 40% from restaurants, 16% from farms, and 2% from manufacturers.

https://www.rts.com/resources/guides/food-waste-america/

Depending on where one lives, the average cost of groceries, according to the USDA, for a family of four in the United States ranges from $1044 – $1568 per month. And if 31% is wasted, that means between $324 – 486 is also wasted each month totaling between $3884 – $5833 per year. For math purposes we will take the average of $4859. If half of the waste can be saved… that is a savings of $2429/yr.

Behaviors that encourage waste are:

- Shopping impulsively – grocery shopping without a list often leads to picking up items you don’t need. Eye-catching displays and sales can tempt you into buying more than necessary, especially if there is no plan on what to make.

- Shopping without a list - Impulse buys can derail your budget. A list helps you stay focused and avoid unnecessary items and waste!

- Buying in bulk without a plan – Bulk buying can save money—if you use what you buy. Without a plan, bulk purchases often go unused and spoil

- Ignoring What You Already Have – may people shop before checking to see what is already in the fridge. So… check your pantry, fridge, and freezer before shopping. Build meals around ingredients you already own to reduce waste.

- Failing to plan meals –Plan meals for the week, utilizing what is already purchased, and creating menus that can work with many of the same ingredients… Before grocery shopping. This helps you buy only what you need and ensures you use up what you purchase.

- Throwing Away Leftovers – Utilize leftovers for lunches, or add with eggs for a surprise omelet, or freeze leftovers or extra ingredients. Even fresh produce can be frozen and used in stews and dishes with sauces (like pot-0pies). Freezing food extends its life and reduces waste. You can also freeze individual portions for easy future meals.

Outside the Home

Eating out as a treat is wonderful! Eating out as a lifestyle is expensive and, let’s be honest, usually less healthy than eating home cooked meals.

In an article by Escoffier, based on a review of USDA data, American’s spent 55.7% of their food spending away from home in 2023 (including dine, and take out). Wow! That is a lot of money leaking! Then add in tipping which, for 45% of American’s, means an additional 20%.

https://www.escoffier.edu/blog/world-food-drink/consumer-dining-trend-statistics/

When inflation rises, restaurants tend to increase their prices at a greater rate than purchasing food at a grocery store, further increasing the difference in cost.

Let’s look at two scenarios:

Joe has a family of four and they go out to eat once a week. It’s a tradition. With an average ticket of $25 each, he spends about $100 plus tax and tip for a total of $130. The rest of the week they eat in. But Joe also grabs a plain coffee ($5) on the way to work ~ three times a week and goes out for lunch ($20) a couple times a week. If Joe backed off by just one of each of those, the money saved for a month would be $170 or $2040 per year. And if dropped in half would be a savings of $370 or $4440 per year.

Sandy works in an office job. Her colleagues go out to eat every day spending ~15 for a total of $75/week. Sandy brings her lunch every day except one *(where she joins her colleagues) spending ~5 for homemade plus the $15 for a total $40/week, saving $2080 at the end of the year. She also skips the fancy coffee run, electing to bring her own coffee. Another daily savings of ~6.50 for a total of $32.50/week and $1690/year. Sandy saves $3770 more than her colleagues simply on lunch and coffee over the year.

Its pretty clear that making meals vs buying them out plugs the holes of leaking money.

Actions:

- Pull debit/credit card statements and add up the amount from one month of eating out. Try cutting it in half, or start with one less of each category per week. Its great to patronize your local restaurants and support people’s livelihoods, just remember to make a conscious decision based on your financial health.

- Add a reminder on your calendar to check next month’s debit/credit statements to see how much you were able to reduce each month.

- Pull cash each month for budgeted “food out” spending. When the cash is gone, no more eating out that month.

- Tip on the food total vs the bill total. Most people look at the bottom line and tip on the total. For states or cities with sales tax, look at the food total and tip on that line vs the higher amount which includes tax.

- Then take that money and invest! Or Save! Or create an emergency fund! Or pay off debt! Then keep reducing the spend over time for even more savings.

Online meal delivery

Delivery used to mean pizza or Chinese food and the restaurants delivered the food. Fast forward to a post Covid society and anything can be delivered. And, although it was great during Covid, that means much more expensive food. Typical delivery services mark up the food, charge for the delivery, and add in a service charge. For small orders there may be a “small order” charge as well. Then there is the tax to be applied and the optional driver tip which most American’s feel obligated to pay.

Here is an example:

Gourmet Hamburger $17

Tax $1.70

Subtotal $18.70

Food Mark Up $2.50

Delivery $3.50

Service Fee $0.90

Tax $0.69

Subtotal $7.59

Total $26.29

Optional Tip $ 3.00

New Total $29.29

For a $19 burger….

If this was a weekly occurrence (or a monthly occurrence for a family of four), picking up the order instead would save $550.68 over the course of a year.

Actions:

- Limit food delivery for unique circumstances (like your car is in the shop, or sometimes you are just exhausted and need that helping hand) verses every day or weekly orders.

- If possible, eliminate entirely or pick the food up (ideally on the way home from somewhere so there is no additional gas cost!)

Shopping Composition

Even those that do almost all their food buying at a grocery store can leak money without realizing it.

- Purchasing Convenience Foods and Prepackaged Meals – Ready-to-eat foods are convenient but come at a premium price. The price includes the cost for preparation and packaging and it significantly higher that only the raw ingredients. It is similar to eating out. There are times it is worth it, but make it the rare event vs. the everyday.

- Heavy on meat & dairy – Meats and dairy products are the most expensive food types after prepared food. To reduce money leaks, have a plan and balance meat and dairy with fruits and vegetables that add nutrition to the body and savings to the bank account.

- Brand name vs store brand. Brand names come with higher prices. But think about where those “store brand” products come from. The store rarely “makes” the product themselves but makes a deal with a company already making it. Sometimes it is even the exact same product. Unless there is a material quality/taste difference, shift to store brands.

- Purchasing non-food items – grocery stores specialize in food but many times add convenience items to their offerings like batteries, toilet paper, and plants. And these convenience items come at a premium cost, having a much higher markup than food. Try to stay aware from buying non-food items at a grocery store and instead purchase from stores that specialize in those or have bulk discounts. For example, big box retailers will be much cheaper on plants and batteries.

Example:

Convenience Food – less one per week; Savings: $15

Store brands vs. brand names; Savings $10

TP & paper towels (discount grocer or big box every other week; Savings: $20

Weekly Savings: $35 Yearly Savings: $1,820

Shopping Locations

One of the most overlooked money leaks in a household budget comes from where a person chooses to shop for groceries. Believe it or not, the same apple or box of cereal can vary in price significantly depending on the type of store, its location, and even whether it's a union or non-union shop.

- Big-name supermarkets often come with big-name prices. These stores typically offer a clean, convenient shopping experience, wide selection, and premium services—but they also charge a premium for those services. From a straight business perspective, all that square footage behind the scenes to create those services must be paid for with the products in the store. So, all the prices must be higher to pay for the overhead (including labor). Unionized locations may also have higher labor costs, which can translate to higher prices on the shelf. This isn’t a knock against supporting union labor (there are good reasons to do so), but it’s something to be aware of when comparing prices.

- Boutique or specialty stores—places that focused on organic, natural, or gourmet items. These often come with a premium price tag. And while you might love that artisanal cheese selection, shopping here regularly for staples could quietly drain your wallet.

- Geography – also plays a role. Stores in higher-income neighborhoods may price items higher than the exact same chain in a lower-cost area, purely based on what the market will bear. And some stores adjust prices based on their competition nearby—if they’re the only game in town, you may not be getting a deal.

- Discount grocers operate on a different model. They often offer limited brands, smaller square footage, and fewer frills—but the savings can be substantial.

- Warehouse clubs offer bulk pricing, which can be a money-saver if you have storage space and won’t let those giant tubs of yogurt go to waste. If storage is issue, or products will go bad prior to consuming, split with friends or family to gain the price advantage without the waste.

Smart shoppers compare prices, know which stores offer the best deals for which items, and don’t mind splitting their grocery list between a few locations. It takes a little effort, but the savings can really add up—and plug a leak you may not have realized was costing you hundreds each year.

Here is an example of two different locations within 10 minutes of each other with pricing for a Granny Smith apple and Cheerios. One is from a big-name fancy supermarket, one from a large grocery. What a difference! If a person purchased 30 items on average each week with a per product difference of only $1 shopping at the lower priced store, they would save $30 every week! And by the end of the year savings would be $1,560! And many of the products are even less than $1. Imagine if all shopping was done with this mind!!

The Bottom Line

If all of these suggestions were acted on, the savings in a year could be as much as $10,799.

If only half that money ($5400) was invested each year (the other half going to pay down debt or create an emergency fund) at a 6% return for ten years it would be worth:

$62,053!!

How’s that for some motivation?

Specific Actions to Take

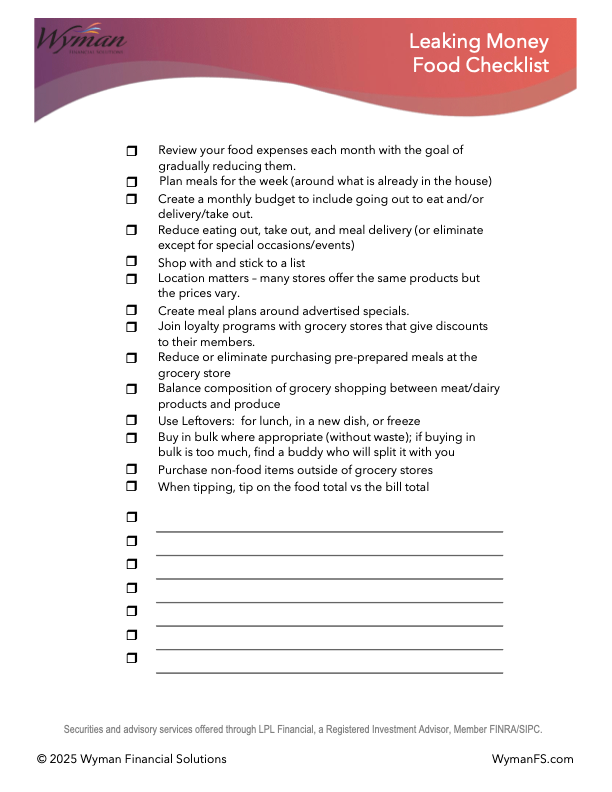

Stopping food money leaks requires awareness, discipline, and a proactive approach to managing expenses. Here is a summary of steps to take that may keep more money in your pocket. You can also download these steps for easy reference.

If staying on budget is too difficult with easy access to funds via a credit card, set a budget and use only cash to stick to it! Knowing there is only cash to use changes the way a person thinks, and adds, when shopping!

Final Thoughts

Plugging the financial leaks in your life isn’t just about cutting costs—it’s about redirecting money toward what truly matters. Every dollar that slips through the cracks is a dollar that could have been saved, invested, or used more effectively like:

- Building an emergency fund

- Paying down debt faster

- Saving for major life goals like homeownership or education

- Accumulating wealth for retirement

Food is essential, but food spending doesn’t have to drain your wallet. By becoming more intentional with your food choices, planning meals, reducing waste, and cooking at home, you can plug one of the biggest financial leaks in your budget. The money you save today can help you build a more secure and enjoyable retirement tomorrow. Small shifts in your habits now can make a big difference over time.