Protecting Yourself Financially from Hackers and Data Leaks: More Than Just Financial Advice

When you think about advice from a financial advisor, you probably expect tips on budgeting, retirement planning, or investment strategies. But in today’s digital age, financial security goes beyond managing your money—it also means safeguarding your personal data from hackers and fraudsters.

Cybersecurity may not be the first thing that comes to mind when you think of financial health, but the two are closely linked. A data breach can lead to identity theft, drained accounts, and long-term financial damage. That’s why this article isn’t just about building wealth—it’s about protecting it.

Let’s explore how you can defend your finances from hackers, RFID theft, and data leaks, and take steps to ensure your hard-earned money stays safe.

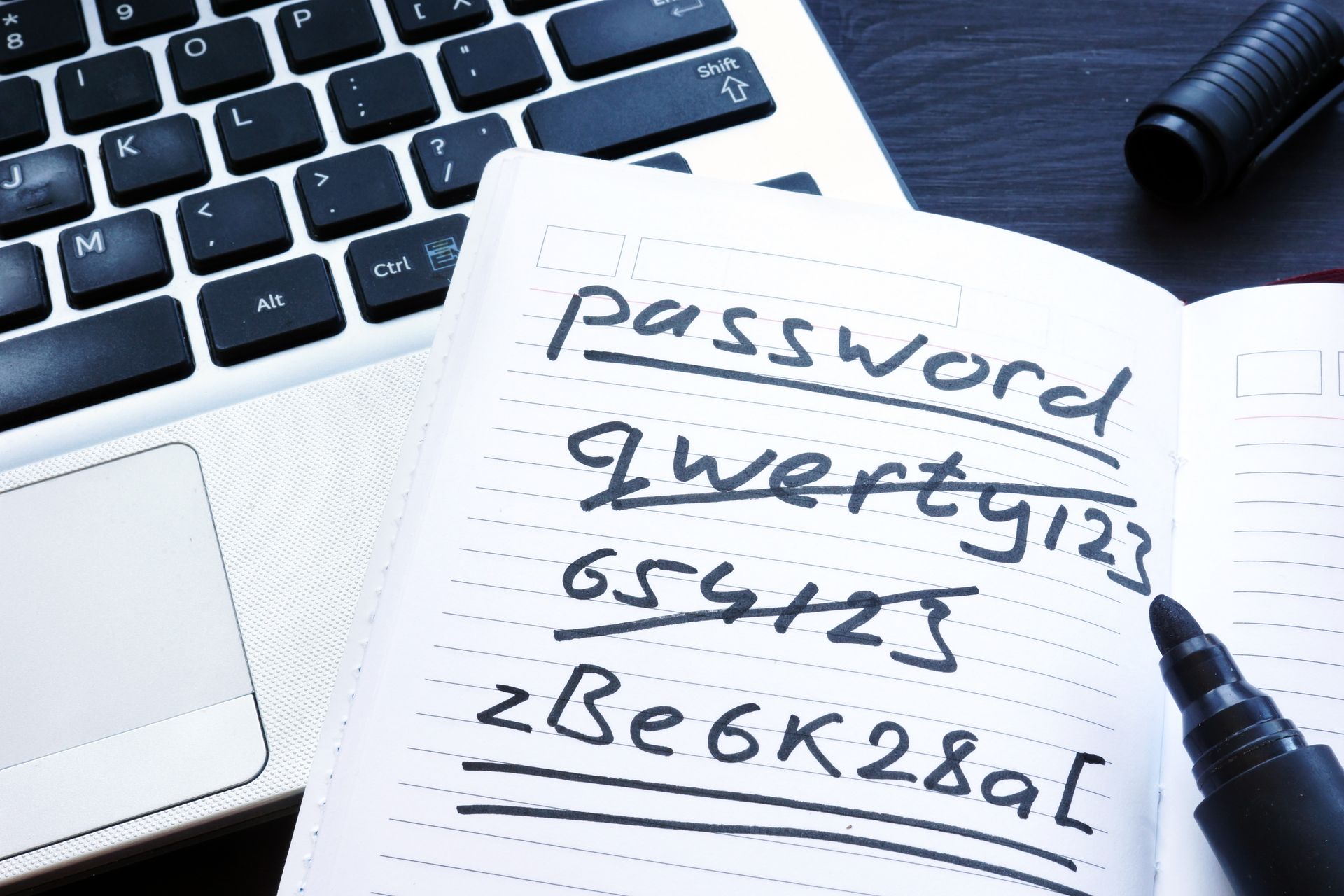

1. Strengthen Your Passwords and Use Two-Factor Authentication (2FA)

Weak passwords are a primary target for hackers, and reusing the same password across multiple sites puts your financial information at even greater risk. A strong password includes a combination of letters (upper and lowercase), numbers, and symbols. Try to avoid common words or predictable sequences (like “password123” or your birthdate).

Using a password manager could be a way to keep track of your unique passwords across different platforms. A manager can create complex passwords for you and store them securely.

In addition to strong passwords, enabling two-factor authentication (2FA) adds another layer of security. This typically involves sending a code to your phone or email, which you must enter alongside your password. Even if someone gains access to your password, they won’t be able to access your account without that additional code.

Example: Many financial apps and services offer 2FA options, such as banks or mobile payment services. If a hacker manages to steal your login details, 2FA prevents them from gaining full access to your accounts.

2. Protect Your Credit Cards from RFID Theft

RFID (Radio Frequency Identification) technology is used in many modern credit and debit cards to allow contactless payments. While this is convenient, it also opens the door to potential RFID skimming, where criminals use a device to remotely scan your card information without your knowledge.

To combat this, you can invest in an RFID-blocking wallet or card sleeves, which prevent these scanners from accessing your card’s data. While RFID theft isn’t as common as other types of fraud, it’s an inexpensive precaution that can help protect you.

Example: If you frequently travel or use public transportation, you might encounter crowded spaces where RFID skimming is more likely. Using an RFID-blocking wallet when traveling in these areas can shield your financial data.

3. Monitor Your Credit Regularly

One of the best ways to detect suspicious activity early is by monitoring your credit report. By law, you are entitled to a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once a year. This allows you to check your credit every four months for free.

Regularly reviewing your credit report allows you to spot unauthorized accounts or credit inquiries made in your name. If you notice any unusual activity, report it immediately to the credit bureau and the lender in question.

Additionally, consider using credit monitoring services, which provide real-time alerts for any changes in your credit report. Some banks and credit cards offer these services for free.

Example: A common form of identity theft involves fraudsters opening new credit cards or taking out loans in someone else’s name. By regularly monitoring your credit report, you can catch these incidents before they escalate into major financial damage.

4. Freeze Your Credit if You Suspect Fraud

If you believe your personal information has been compromised, freezing your credit can prevent identity thieves from opening new accounts in your name. When your credit is frozen, lenders won’t be able to access your credit report, which makes it difficult for fraudsters to apply for credit in your name.

Freezing and unfreezing your credit is free and can be done online through each of the three credit bureaus. You can also place a fraud alert on your credit report, which warns potential lenders to take extra steps in verifying your identity before issuing credit.

Example: If your wallet is lost or stolen, freezing your credit right away can prevent identity thieves from using your Social Security number or other information to apply for new credit accounts.

5. Be Cautious of Phishing Scams

Phishing scams are one of the most common tactics hackers use to gain access to personal and financial information. These scams often come in the form of emails or text messages that appear to be from legitimate companies, like your bank or credit card provider, asking you to click a link or provide sensitive information.

Be cautious when opening unsolicited emails, especially those with urgent-sounding messages or unfamiliar links. Always verify the sender’s email address, and never provide personal information through an email link. When in doubt, contact the company directly using a verified phone number or website.

Example: Imagine receiving an email from “your bank” asking you to confirm your login information due to suspicious activity. Rather than clicking the link, go to your bank’s website directly to log in and check for any alerts. Often, these phishing emails are designed to trick you into giving away your login details to fraudsters.

6. Use a Virtual Private Network (VPN) on Public Wi-Fi

Public Wi-Fi networks, such as those in coffee shops or airports, are often unsecured, making it easier for hackers to intercept data as you browse. Using a Virtual Private Network (VPN) adds a layer of encryption between your device and the internet, making it difficult for hackers to access your information.

When conducting any financial transactions online—whether checking your bank account, making payments, or shopping—using a VPN can safeguard your information. Avoid logging into sensitive accounts or entering payment details when using unsecured Wi-Fi without a VPN.

Example: A traveler sitting in an airport terminal might check their bank account balance using public Wi-Fi. If a hacker is monitoring that network, they could capture the traveler’s login credentials. Using a VPN would encrypt the traveler’s data, keeping it safe.

7. Guard Your Social Security Number

Your Social Security number is a key piece of information hackers use to steal identities. Be very cautious about where and when you provide this number. Avoid carrying your Social Security card in your wallet, and don’t provide it unless absolutely necessary.

When asked for your Social Security number by a company or service, always ask why it’s needed and if there are alternative forms of identification you can provide. In many cases, businesses request this information out of habit rather than necessity.

Example: You receive a phone call from someone claiming to be with the IRS, asking for your Social Security number to verify your account. The IRS will never call and ask for this information over the phone—this is likely a scam. Always be cautious about where you provide this sensitive information.

8. Keep Software and Devices Updated

Outdated software can have security vulnerabilities that hackers exploit to gain access to your devices and personal data. Regularly updating your computer, smartphone, and any apps—especially those related to finances—ensures you have the latest security patches installed.

Enable automatic updates when possible, and make sure that your antivirus software is always up to date.

Example: A hacker could exploit an outdated mobile banking app to gain access to your financial information. Keeping the app updated helps close these vulnerabilities and protects your data.

In conclusion, protecting yourself financially from hackers and data breaches requires diligence, but the steps are straightforward. By taking action—like strengthening passwords, using 2FA, guarding against phishing, and monitoring your credit—you can significantly reduce the risk of financial fraud. Remember, staying informed and being proactive is the best defense against potential cyber threats.

“Fortune Favors the Prepared Mind”

Dr. Louis Pastuer