Managing Retirement Throughout Your Life: A by Decade Guide to Financial Organization

Retirement planning is a lifelong journey that evolves as career, goals, and life circumstances change. Whether just starting a career, in peak earning years, or approaching retirement, taking an organized and strategic approach to managing investments is crucial. This article lays out a roadmap by decade for your retirement journey.

20’s: Early Career - Laying the Foundation

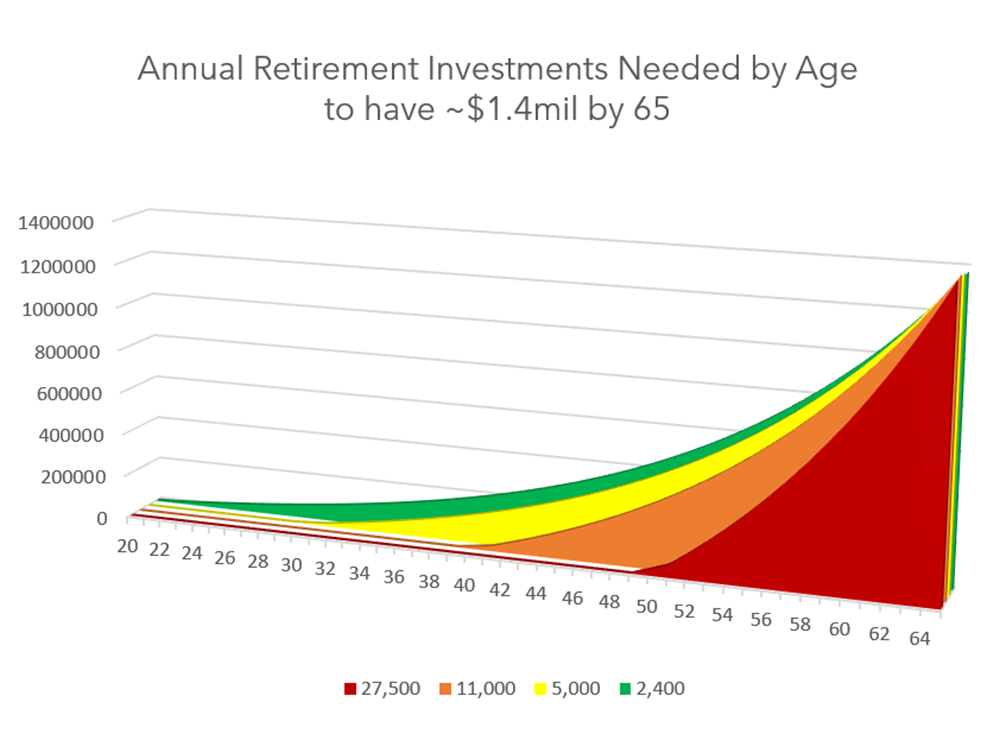

It’s all about Compounding. Twenties are the BEST time to take advantage of compounding because there is the most time for it to work. For example, the chart shows, if a person invests $2,400/year starting at age twenty, with a 7% return, by 65 they will have ~$1.4 mill with only $108k of their money invested. At 30, to have the same amount of money by age 65, it requires $5,000/yr with a total investment of $175k; at 40: $11k/yr and $275k invested, and by age 50 $27.5k/yr with an investment of $412.5k. That is a HUGE difference!! You can read more in our compounding article.

Here are some ways to get started.

- Open a Retirement Account: If your employer offers a 401(k) or similar retirement plan, make sure to enroll. If not, consider opening an Individual Retirement Account (IRA) or a Roth IRA.

- Automate Contributions: Set up automatic contributions to your retirement accounts to ensure consistent saving. Even small amounts can grow significantly over time, thanks to compounding.

- Diversify Your Investments: Even if you're just beginning, it's important to spread your investments across various asset classes, such as stocks, bonds, and use of mutual funds. Diversification helps reduce risk and smooth out returns over the long term.

30’s: Mid-Career - Building and Growing

Note: If you have kids make sure to also have a will. Many people put this off until “later”, but that could be too late. If children are minors a guardian must be chosen. Without legal documentation, the court decides where children go and that could be in foster care. See more in our Will article.

- Build and grow investments. Thirties are a great time to build on the foundation set in the twenties OR start!! There is still time to take advantage of compounding. Talk with a financial planner who can education you on new products and opportunities only available to professional planners vs. individuals.

- Forecast what retirement may look like. Find a financial planner or online tool that can help forecast income at retirement based on current savings and investments. Its early enough to change course if needed and create a strategy to implement over the next twenty years. Caution: Many of these tools show actual dollars but fail to take into consideration inflation and taxes, lulling a person into a false sense of security. If it feels too easy… it most likely is.

- Balance between Taxable vs. Non-taxable retirement income. Ideally, you want a balance between income that will be taxed during retirement and income that will be tax-free. This enables more take home money with a much lower tax base. We don’t know what taxes will look like down the road; if taxes will go up or not.

40’s: Retirement Planning Push – Fill in the Gaps

It’s time to do a deep-dive and evaluate your current situation. Do you have a concrete strategy? If so, has it been followed? Does it need catching up. Start thinking about what retirement might look like and what kind of lifestyle you want

- Forecast Retirement Income. In your 40s, it’s crucial to forecast how much your current retirement portfolio and contributions will provide at retirement. Use retirement calculators or, better yet, work with a financial advisor to project your future income.

(Many people forget to factor in inflation, so make sure to include what buying power your future income may have. For a deep dive check out our inflation article.)

- Consider Tax Implications: Diversify your tax exposure by using a combination of tax-deferred accounts (like traditional IRAs and 401(k)s) and tax-free accounts (like Roth IRAs). This strategy can help manage your tax burden in retirement.

- Create a debt reduction strategy: Managing debt is key to retirement planning; focus on paying off high-interest debts and aim to have major loans, like your mortgage, paid off before retirement. Reducing debt frees up cash flow for retirement savings and makes retirement income stretch further.

Find the gaps in your retirement portfolio and

take action! Again, meet with a financial planner and really focus on what needs adjusting in your investments or strategy. Take a good look at spending and look for areas that can be scaled back in order to set up a good retirement. Your future self will thank you!!

50’s: Get up to Speed – Final Push

Retirement is close! For some only a few years away. For others, especially for those that lacked action earlier in life, a bit longer. But either way, it’s coming up fast! Reassess!

- Create a Concrete Retirement Vision & Budget. In your 50s, it’s time to detail what your retirement vision is and how much money will be needed to fulfill it. Create a detailed budget that includes daily living expenses, healthcare, property tax, emergencies, and any planned activities or travel. (Wyman has both a retirement vision form and detailed budget to help get you started. Contact us for more information.)

- Reassess Retirement Forecast: Review and update your retirement income forecast how much money you will receive with your current retirement funds. Take a realistic look at when to take social security, considering the whole picture and the ramifications of taking it too early.

- Forecast the Financial Picture for Each Spouse If the Other Passes Away. If married, forecast the financial picture for each spouse if the other passes away. This catches many people by surprise and may leave the surviving spouse in a poor financial position.

60’s: Pre-Retirement - Fine-Tuning Your Strategy

As you get closer to retirement, your focus should shift from growth to preservation and income.

- Create a Retirement Budget: Take an in-depth look at how much your idea of retirement will cost. Remember to include medical costs, and plan for the unknown as well as every day items and hobbies/interests.

- Reassess Your Risk Tolerance: As you near retirement, you may want to reduce the risk level of your investments to protect your savings from market volatility. When reducing risk, consider having a portion of your portfolio aimed at moderate growth to outpace against inflation over your lifetime.

- Plan for Withdrawals: Develop a withdrawal strategy that aligns with your lifestyle needs and minimizes taxes. Understanding Required Minimum Distributions (RMDs) and how they apply to your accounts is crucial to avoid penalties.

The Importance of Regular Reviews

Retirement planning is not a set-it-and-forget-it endeavor. Regularly reviewing your retirement strategy can help you stay on track to reach your goals. As life events like marriage, buying a home, or having children occur, make sure to update your plan to reflect these changes. Consider setting an annual or bi-annual review with your financial advisor to ensure your investments align with your evolving goals.

Final Thoughts

Managing retirement throughout your life requires a proactive and organized approach. Whether you’re just starting out, in your mid-career, or approaching retirement, taking the time to understand your investments, how to handle job changes, and the pros and cons of investment strategies can make all the difference. By staying informed and regularly reviewing your financial situation, you can navigate your path to retirement.

Remember, retirement is a journey and a destination. The more prepared you are, the smoother the journey will be and the more comfortable once you get there.