Invest in Inflation-Linked Assets

One way to hedge against inflation is by investing in assets that typically outpace it. Historically, stocks have outperformed inflation over the long run, making them an essential part of a retirement portfolio. While stocks are volatile in the short term, they offer growth potential that can help counteract the eroding effects of inflation, over the long haul.

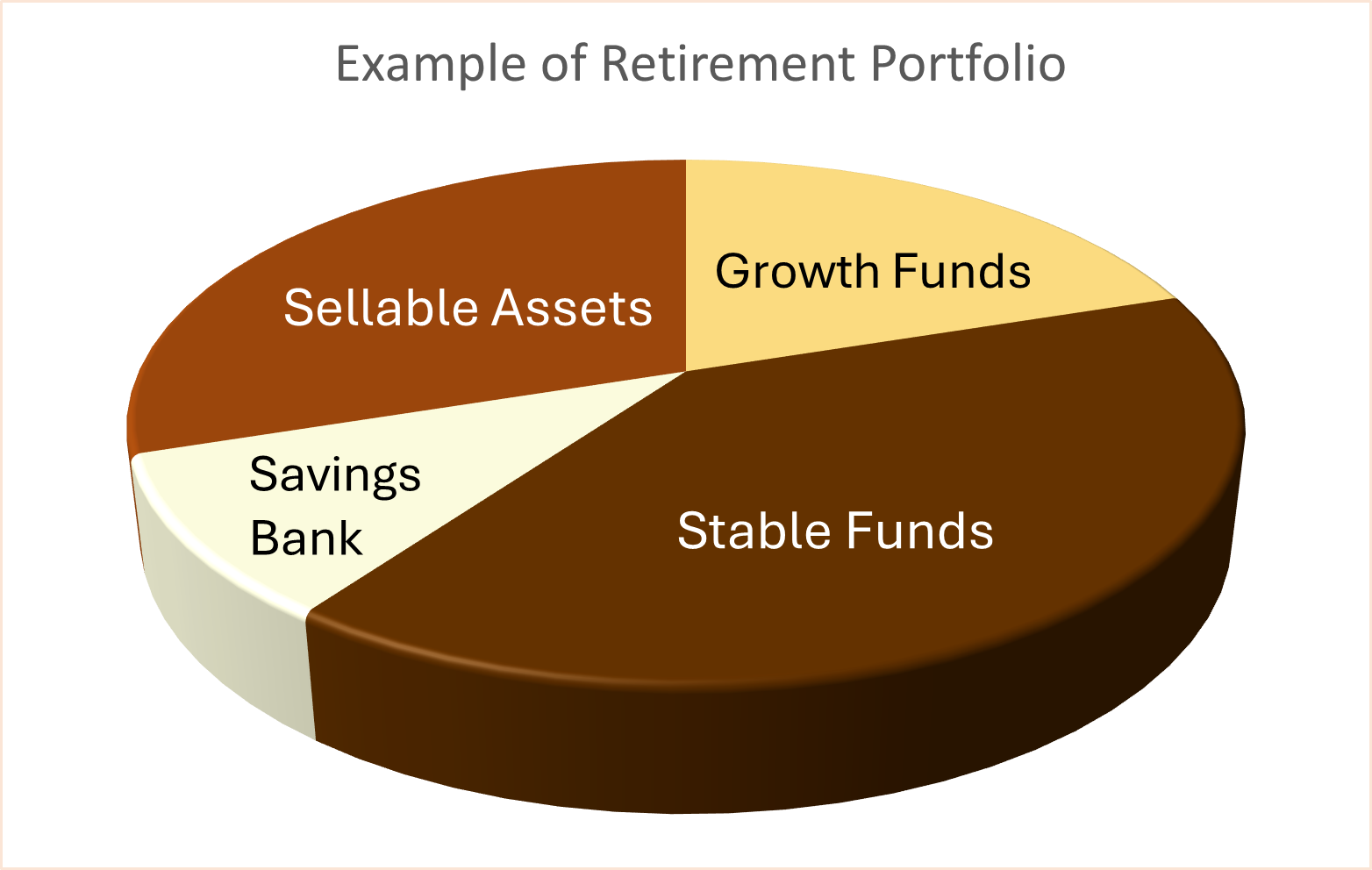

Example: A balanced retirement portfolio might include a mix of stocks, bonds, and other assets like real estate. This diversification spreads risk while allowing for growth.

You can also consider Treasury Inflation-Protected Securities (TIPS). These government bonds are designed to protect investors from inflation. The principal value of TIPS increases with inflation, ensuring your purchasing power isn’t eroded.