"Fortune favors the prepared mind."

Dr. Louis Pasteur

Wyman Financial Solution's Mission

Our education system and society

does not prepare people to handle money well. Instead of teaching how to be financially healthy, we are bombarded with consumerism, for the now, and instant gratification. Those marketing ploys are designed to part you with your money, not to take care of you, your dreams, or your future.

There are so many creative and new ways to invest that

most people are unaware of. Every piece of the work we do, comes with an educational component. We want people to understand their options so they can make informed decisions and own their choices.

Our mission is to educate people on what their options are, many of which are unavailable to purchase as an individual.

In their life, at some point, we want people to say, "It was a good thing I had a conversation with Wyman." because we made a difference in their lives.

Karen Hansen

President, Wyman Financial Solutions

Meet Karen - President

We help you get from here...

to where you want to be.

Are financial concerns keeping you up at night? Do you find yourself navigating the complex world of finance feeling overwhelmed and uncertain?

Maybe you are anxious about retirement, worried about market volatility, or afraid you will run out of money.

Are you are ready to review your financial situation and make sure you miss the pitfalls that most American's find themselves making?

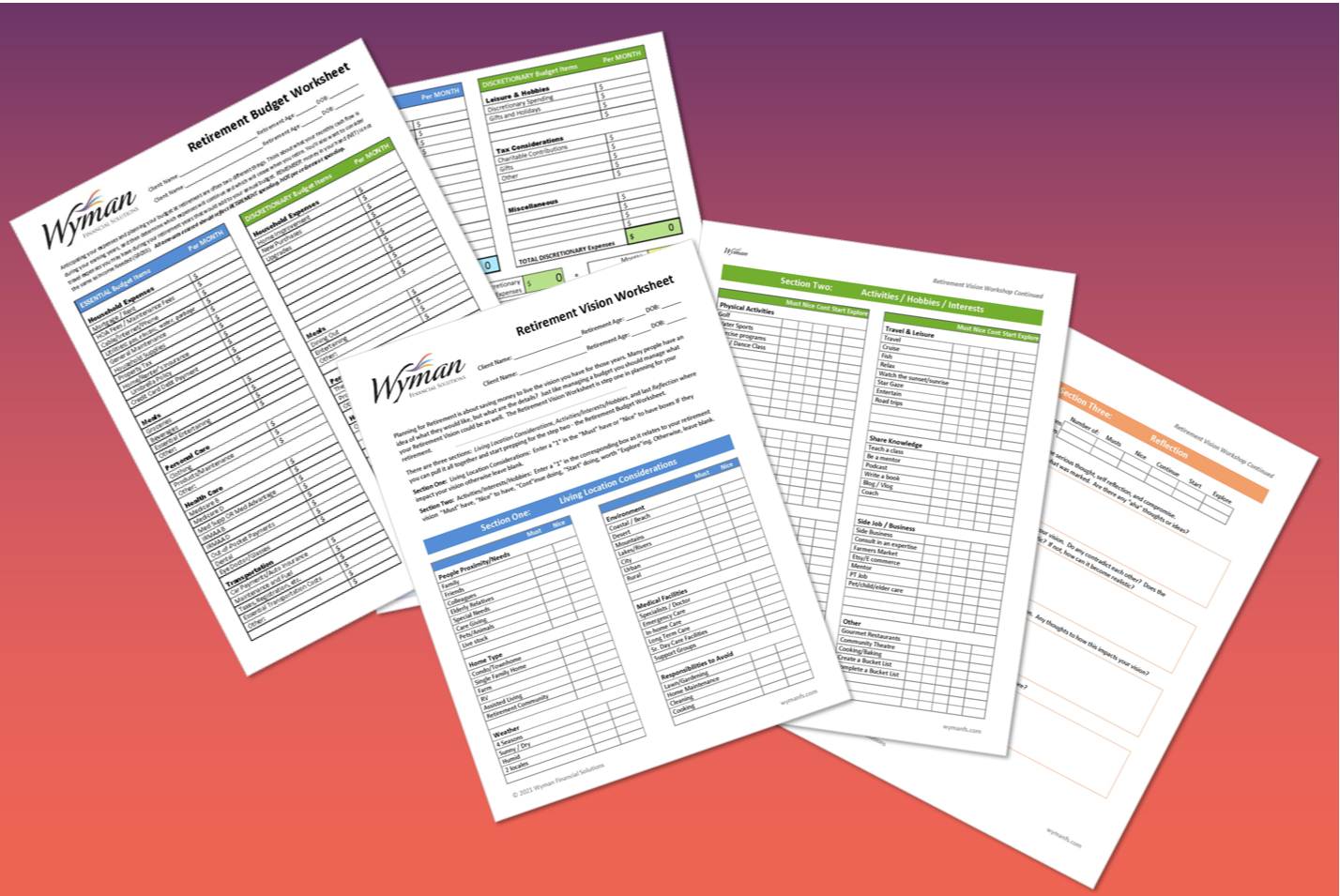

We are ready to chat with you. And in the meantime, download free

The Top Eight Piftalls in Finances below.

Studies show, people working with a Financial Advisor...

may have a leg up vs. those that don't. Multiple studies show1, people working with a financial advisor are more likely to engage in thoughtful retirement planning, tend to save more and benefit from behavioral coaching.

1MIT AgeLab and Sociate of Actuaries Study 2018; Cerulli Associates Study 2020; Vanguard's Advisor Alpha Study 2019;

What We Do

We create possibilities. Below is a sample of the many product categories we offer.

Strategy

~ Financial / Tax Review

~ Charitable, Legacy

~ College Planning

~ Investments

For Business:

~ Financial Planning

~Exit Strategies

~Tax Review

Retirement

~ Right Sizing Retirement

~ 401K Rollovers

~ IRA / ROTH

~ IRMAA

For Business:

~ 401K; SEP

~ SIMPLE; Keogh

` Defined Benefit Plans

Insurance

~ Medicare / Supplementals

~ Long Term Care

~ Life Insurance

~ Disability

For Business:

~ Group Medical Plans

~ Buy/Sell Agreements

~Key Man; Diability

How We Do It

By getting to know your story and unique needs plus education and collaboration.

Get to Know You

Our journey begins with a no-obligation initial consultation. to get to know each other, discuss your financial objectives, and explore how we can add value to your financial journey... and answer any questions you may have.

Goals & Financial Analysis

We work collaboratively to identify and define your short-term and long-term financial goals, along with an analysis of your current financial status. Your situation is unique and your plan must be as well.

Education & Planning

Next, we create a personalized financial plan that addresses your unique objectives. Along the way we empowering our clients through financial education.

Implementation & Checkins

Now its time to take action and implement the plan. Regular check-ins and updates ensure that your plan remains aligned with your evolving goals and market conditions.

Ready to get started?

Embark on your financial journey with Wyman Financial Solutions. Our process is designed to be collaborative, educational, and tailored to your unique needs. Contact us today to schedule your initial consultation and take the first step toward achieving your financial goals.

We are not a good fit if you...

- Prefer quicker fixes over long-term strategies

- Resist open communication

- Disregard the importance of financial education

- Chase high-risk strategies without understanding

- Seek market timing as a primary strategy

- Are unwilling to adapt to changing financial goals

- Prioritize investment returns over risk management

- Lack commitment to financial planning

About Wyman

Wyman was started in 1976 by Larry Wyman. When he passed away Karen Hansen took over and has expanded the company and offerings over time to more completely impact the financial needs of our clients. Larry always did what was best for his clients and educated them along the way. Nothing is different today for Wyman. The term fiduciary has always applied to our work and mindset. We are proud to be a part of the continued legacy of a company with that track record and sustain the work that Larry began.

"Every client has a unique vision, starts from a different place, with different resources. I listen to your needs then help put all the puzzle pieces together to fit your vision. I operate honestly. I have many resources. If it isn’t me, I will find you the qualified source.”

Karen Hansen, President

FAQ's

What are your services?

We provide a comprehensive range of financial services, including age long planning & investment, retirement planning, and tax awareness. Our goal is to offer a holistic approach to address your unique needs.

How do I get started?

It's simple! Contact us to schedule an initial consultation. We'll discuss your financial goals, explain our services, and determine how we can assist you on your journey.

Do I need a certain level of income or wealth to work with you?

We work will all levels of clients. Our ideal client makes $100k or more annually.

What is your investment philosophy?

Our investment philosophy is grounded in a disciplined, diversified approach tailored to your risk tolerance and financial goals. We believe in long-term strategies that weather market fluctuations and aim for consistent, sustainable, & growth.

How do you charge for your services?

Our fee structure is transparent and based on the services you require. During the initial consultation, we will discuss our fees and ensure you have a clear understanding of the value you receive in return for our services.

What is a fiduciary?

This is a person who places the client’s needs before thinking of the money they will earn. That is always our mindset and Karen holds a Certified Financial Fiduciary Certification

How often will we meet?

Button

ButtonThe frequency of meetings depends on your preferences and the complexity of your financial situation. During the initial planning stages, we'll establish a meeting schedule that suits your needs, whether it's quarterly, semi-annually, or annually.

What if my financial situation changes?

Life is dynamic, and we understand that your financial situation may change. We encourage open communication, and if there are any significant changes in your life or goals, we will work together to adjust your financial plan accordingly.

How do you stay informed about changes in the financial landscape?

Our team is committed to staying up-to-date with the latest trends, regulations, and market developments. We regularly attend industry conferences, engage in continuing education, and collaborate with a network of professionals to ensure we provide you with informed and timely advice.

Why should I choose Wyman Financial Solutions over other advisors?

Wyman Financial Solutions stands out for its commitment to personalized, educational, and transparent financial services. Our focus is on understanding your unique goals and empowering you to make informed decisions about your financial future.

Ready to get started now?

Do you have more questions? Ready to schedule a chat? We are here. Call, email, or click the Contact button below.